The Impact of Capital Structure on Business Performance : A Critical Evaluation

The Impact of Capital Structure on Business Performance : A Critical Evaluation

Introduction

Capital structure refers to the way a company finances its overall operations and growth through different sources of funds. These sources typically include debt (loans, bonds) and equity (shares issued to investors). The mix of debt and equity a business uses is crucial because it affects the company’s financial health, risk levels, and ability to generate profit. This article critically evaluates how capital structure influences business performance.

Understanding Capital Structure

A company can raise funds either by borrowing (debt) or by issuing shares (equity). Debt financing involves paying interest, while equity financing requires sharing ownership and profits with investors. A company must decide on an optimal balance between the two based on its goals, risk tolerance, and market conditions.

- Debt and Business Performance

Debt financing is often viewed from two point of view. From first point of view, debt can boost business performance by providing funds for expansion and growth without diluting ownership. Interest payments on debt are tax-deductible, which reduces a company’s tax burden.

However, the second point of view states that an excessive debt can strain a company’s finances. Large interest payments can become burdensome, especially during economic instability or periods of low profitability. If a company is unable to make its payments, it may face financial distress or even bankruptcy. Therefore, a business must carefully manage its debt levels to avoid overburdening its cash flows.

- Equity and Business Performance

Equity financing, by contrast, involves issuing shares to investors in exchange for capital. This approach doesn’t require regular interest payments, so there’s less financial pressure. A business can use these funds to invest in projects and grow without worrying about meeting debt obligations.

The downside to equity financing is the dilution of ownership. Existing shareholders lose some control of the company as new shareholders come on board. Additionally, distributing profits through dividends to a larger number of shareholders can limit funds for reinvestment. Balancing these trade-offs is key to maintaining business stability.

- Optimal Capital Structure

The optimal capital structure is one that balances debt and equity in a way that maximizes a company’s value while minimizing risks. Companies with stable revenues and strong cash flows may prefer higher levels of debt because they can comfortably make interest payments. On the other hand, businesses with unpredictable earnings may lean toward equity to avoid the fixed burden of debt payments.

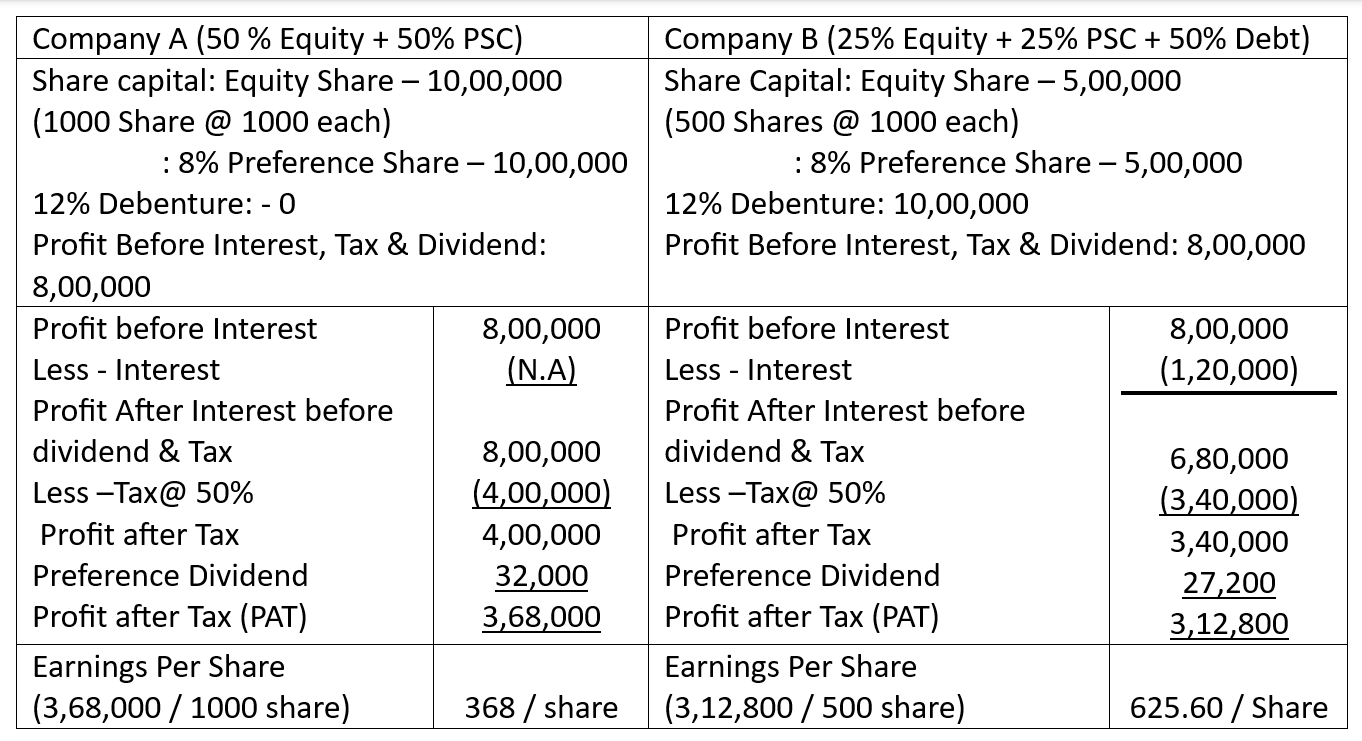

Lets Understand With the help of a simple illustration.

- The Impact on Financial Ratios

Capital structure directly affects several financial ratios used to assess a company’s performance. For example:

– Debt-to-equity ratio: A high ratio indicates that a company is relying more on debt, which increases financial risk.

– Return on equity (ROE): Higher debt levels can sometimes increase ROE because less equity is used, but it also increases the financial risk.

These ratios provide insights into a company’s financial health, helping investors and managers make better decisions.

Conclusion

The impact of capital structure on business performance is complex and multifaceted. While debt can enhance returns, it also brings added risk, especially if not managed carefully. Equity provides stability but can dilute ownership and reduce profit retention. A company must critically evaluate its capital structure to strike a balance between growth, risk management, and profitability. The right capital structure, designed as per the company’s specific needs and industry conditions, can lead to improved business performance and long-term success.

The article provides a clear overview of the concept of dilution of ownership and its impact on capital structure. It highlights the trade-offs between debt and equity financing and the importance of finding the optimal balance to maximize company value while minimizing risks. The article also discusses the impact of capital structure on financial ratios, which are essential for assessing a company’s performance. Overall, it is a valuable resource for understanding the complexities of capital structure and its implications for businesses.